How Investor Actions and Strategic Timing Can aid Bridging the $4 Trillion Funding Gap to Reduce Emissions by 2050

How can we ensure our building stock is net zero by 2050? Are current sustainable retrofit investments sufficient to meet this target? What does the data reveal about the investments that can enhance the likelihood of firms investing in these retrofits?

The building sector is responsible for between 30 and 39 percent of greenhouse gas emissions, with approximately three-quarters of these emissions originating from the operations of existing properties and their energy consumption1. The United Nations found there is a global funding gap of $4 trillion per year in sustainable investments needed to transition to net zero2, which cannot be filled by government spending alone.

This is where sustainable engagement comes into play. Sustainable engagement occurs when investors file environmental or social shareholder proposals to encourage firms to initiate sustainable investments. Understanding the impact of sustainable engagement on firm behavior and evaluating its effectiveness are crucial to increasing its impact.

Focusing on the Data

A recent National Bureau of Economic Research (NBER) and Center for Real Estate (CRE) working paper investigates the impact of sustainable shareholder engagement on firm investments in real assets. This study utilizes unique microdata to track investments in all public US commercial real estate properties over the past three decades, aiming to estimate the effect of such engagement. Little is known about the conditions under which sustainable engagement positively influences firms’ actions and behavior. In the real estate industry, investments are sporadic and typically follow depreciation cycles. SEC restrictions (rule 240.14a-8) on shareholder proposals, combined with these cycles, create random variations that allow the authors to identify firms’ sustainable investment decisions.

The authors, including CRE postdoctoral fellow Bram van der Kroft, Juan Palacios from CRE and Maastricht University in the Netherlands, Roberto Rigobon of MIT Sloan, and Siqi Zheng, Director of CRE, find that sustainable engagement effectively steers firms to initiate tangible and long-lasting sustainable retrofits. However, engagement is ineffective or even detrimental when it does not align with reinvestment periods or when investors vote down the proposals.

Timing It Right

“Our results highlight the importance of timing sustainable financing, where most prior work focuses on the cross-section,” says Bram, whose research is focused on sustainable real estate finance. He emphasizes the urgency, stating, “Getting this timing right is of first-order importance to attaining net-zero emissions by 2050.” The impact is measurable, as missed engagement opportunities today, “might lock in unsustainable assets for decades.”

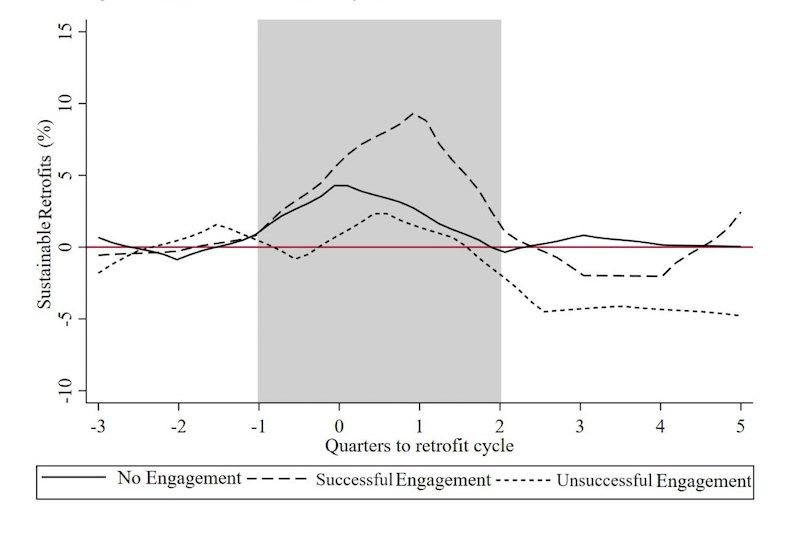

The study reveals that sustainable engagement is most effective when physical assets are near depreciation, as the costs of sustainable improvements are lower when capital expenditures are due. Conversely, engagement is ineffective or counterproductive when firms’ assets are not depreciated. Economically, sustainable engagement during depreciation cycles increases the share of sustainable retrofits by 4.67 percentage points, or 22.62% relative to the average share in the sample. Meanwhile, the share of sustainable retrofits declines by 4.99 percentage points, or 22.99%, for engagements outside these cycles. These findings highlight the critical role of timing in improving firms’ sustainable investments and are graphically displayed in the figure below.

Looking to drive impact and to speed up sustainable investments, the authors suggest that sustainable investors could jointly engage, adjust their portfolios, and provide debt financing for firms needing capital investments at the right time. In addition, policymakers could focus on stimulating new sustainable investments rather than emphasizing firms’ pollution levels. Regulations could provide investors with more detailed information on physical asset depreciation or reduce the lag from shareholder proposal to vote in SEC rules. As Siqi Zheng concludes, “It is not only who but also when investors push firms to change that determines their impact.”

About the Authors

Bram van der Kroft, Massachusetts Institute of Technology (MIT)

Juan Palacios, Massachusetts Institute of Technology (MIT) – Center for Real Estate; Maastricht University

Roberto Rigobon, Massachusetts Institute of Technology (MIT) – Sloan School of Management

Siqi Zheng, Samuel Talk Lee Professor of Urban and Real Estate Sustainability, Faculty Director of MIT Center for Real Estate

References

- EPA, GRESB. Sources of greenhouse gas emissions. Retreived from https://www.epa.gov/ghgemissions/sources-greenhouse-gas-emissions; and What is embodied carbon in the real estate sector and why does it matter? URL: https://www.gresb.com/nl-en/what-is-embodied-carbon-in-the-real-estate-sectorand-why-does-it-matter/

- UN chief urges “surge in investment” to overcome 4 trillion financing gap. URL: https://tinyurl.com/8r23r8wj